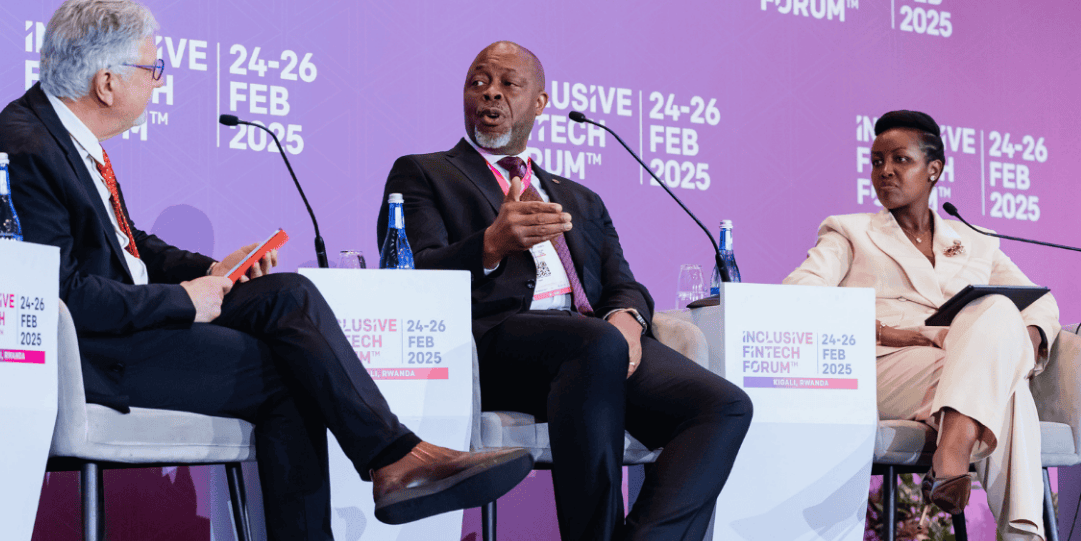

Dr. Yusuf Rakiya Opemi

Director of Payments System Supervision, Central Bank of Nigeria (CBN)

Dr. Rakiya Opemi Yusuf, currently serves as the Director, Payments System Supervision Department at the Central Bank of Nigeria. She is a seasoned financial sector professional with over three decades of extensive experience in development financing, commercial banking, accounting practice and financial system supervision. A strategic thinker and result-oriented leader, Dr. Rakiya has over 15 years' experience at the Financial System Stability Directorate of the Central Bank of Nigeria. Her work spanned both off-site surveillance and on-site supervision of development finance institutions, primary mortgage banks, microfinance banks, finance companies, payments service banks and payments service providers. Amongst strategic objectives coordinated by her was the development of Payments System Vision 2025 strategy document to deepen digital financial service delivery and support inclusive growth of Nigerian economy. Before her appointment as the Director, Payments System Supervision Department, she oversaw payments data management office responsible for monitoring and reporting on the state of the payments system in Nigeria. Dr. Rakiya has through her participation at committees and inter agency assignments, developed policies to strengthen the stability of the Nigerian Financial System. She was immediate past Chairman, Financial Inclusion Channels Working Group and currently serves as Chairman, Nigerian e-Fraud Forum (NeFF). Prior to joining the Central Bank of Nigeria, Dr. Rakiya worked at Nigeria Agriculture and Cooperative Bank, Unity Bank Plc and UHYMaaji & Co. Chartered Accountants.

Dr. Rakiya holds a PhD. in Accounting & Finance (2021), M.Sc. Accounting and Finance (2014); Masters, Business Administration (2002) and B.Sc. Accounting (1990). Professionally certified across a range of financial disciplines: accounting, taxation, forensics, corporate governance, banking, and management. Dr. Rakiya is a member Association of National Accountants of Nigeria, Chartered Institute of Taxation of Nigeria, Chartered Institute of Forensics and Certified Fraud Investigators of Nigeria, Chartered Institute of Stockbrokers of Nigeria, Institute of Chartered Secretaries and Administrators of Nigeria, Society for Corporate Governance of Nigeria, Nigeria Institute of Management and member of Chartered Institute of Bankers of Nigeria. She had served as chairman of committees amongst which are: Audit committee, Chartered Institute of Forensics and Certified Fraud Investigators of Nigeria, ANAN Anti-Corruption Compliance Committee and she is currently the Chairman of Professional Women Accountants in Nigeria.

Dr. Rakiya carved a niche for herself in impacting knowledge and upholding ethical conduct. She has a flare for improving regulatory standards, risk-based supervision, with a strong emphasis on governance, compliance, data-driven decision-making, and supporting national economic development goals. As a Director of Payments System Supervision with responsibility of ensuring efficient, safe and sound payments system in Nigeria, she desires to build a robust, resilient and efficient payments system contributing to robust world payments ecosystem to foster trade.

.png?width=937&height=546&name=Nasdaq_GFTN_937x546%20(2).png)

.png)

.png)

.png)