Mukul Agarwal

Vice President, Nucleus Software Exports Limited

With more than 30 years in the fintech and banking technology space, Mukul Agarwal has built a career around one central belief — that finance should move at the speed of business, not the other way around. As Vice President, Sales for Southeast Asia at Nucleus Software, he has helped banks and financial institutions reimagine how they serve SMEs, replacing one-size-fits-all loans with flexible, tech-enabled models that reflect the realities these businesses face on the ground.

Mukul’s approach blends strategy with empathy. He has led initiatives that open up collateral-free credit channels, made local currency financing more accessible, and used digital platforms to connect lenders and entrepreneurs in ways that speed up access to funds while keeping risks in check.

His work has consistently focused on removing the barriers that slow SME growth. By enabling instant onboarding, automated credit decisioning, and end-to-end loan servicing, Mukul’s work helps financial institutions unlock new lending opportunities for MSMEs that would otherwise remain excluded.

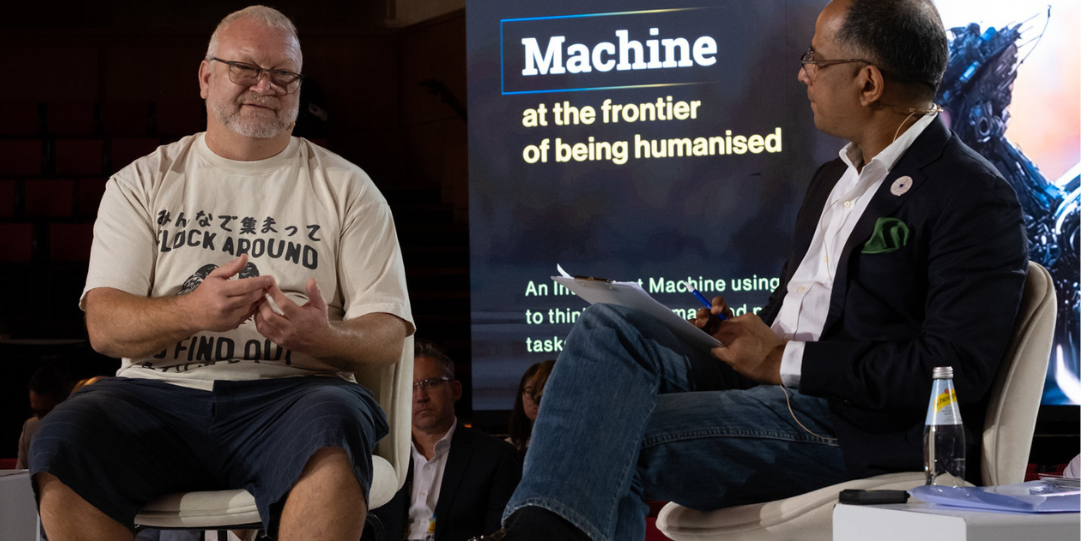

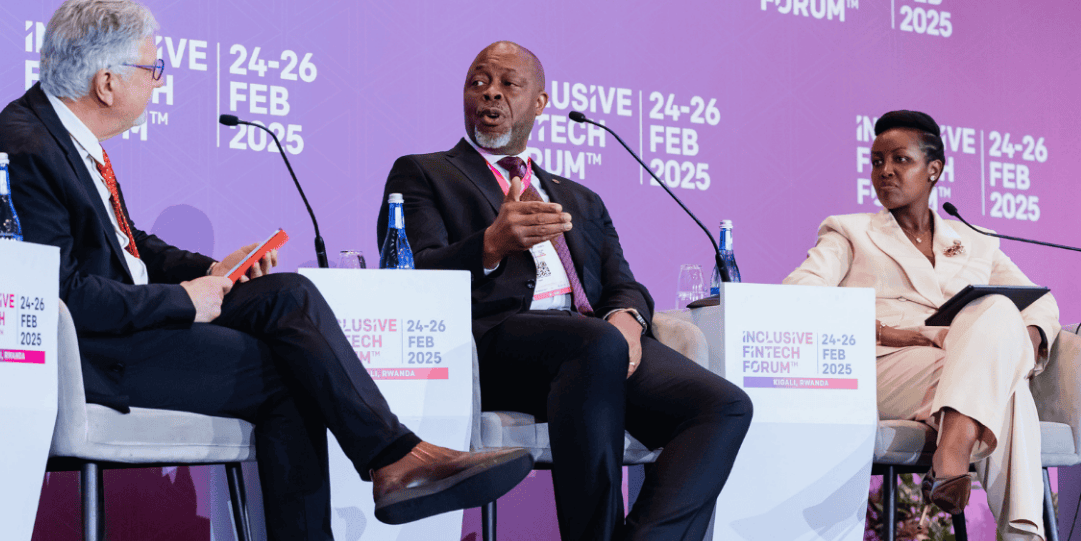

A seasoned speaker and moderator, Mukul has taken the stage at global forums to discuss everything from automating treasury operations to innovation in trade finance. Whether in Hong Kong, the Philippines, or now Johannesburg, his insights centre on how technology — from AI-driven credit assessment to API-enabled financing ecosystems — can transform the SME finance landscape.

At this year’s Insights Forum, Mukul brings not just experience, but a vision: a future where small businesses, regardless of size or location, can access the right kind of financing at the right time — and thrive because of it.

.png?width=937&height=546&name=Nasdaq_GFTN_937x546%20(2).png)

.png)

.png)

.png)