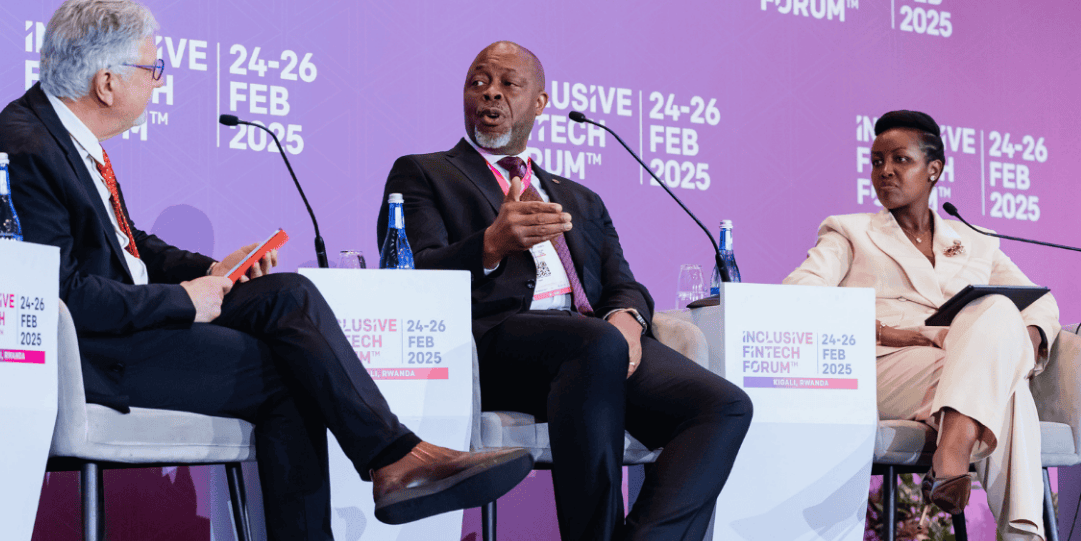

Small and medium-sized enterprises (SMEs) are the backbone of economic growth, yet they remain underserved by traditional finance. Fintechs and digital lenders are stepping in to close this gap with innovative, data-driven lending models — but they face a critical challenge: managing the higher perceived risk of SME borrowers, especially in emerging markets or sectors with limited credit histories.

Credit guarantee institutions can be game changers in this space. By sharing or absorbing part of the default risk, they enable fintech lenders to extend financing to more SMEs, on better terms, and at greater scale. This session will explore how risk mitigation tools — from partial credit guarantees to portfolio insurance and other risk mitigation tools — can empower fintechs to expand their reach, offer affordable pricing, and unlock inclusive growth.

Join industry leaders, fintech innovators, and guarantee providers as we discuss:

- Why risk mitigation is essential for scaling SME lending

- How credit guarantees can catalyze fintech innovation and market entry

- Best practices and partnership models between fintechs and guarantee institutions

- Other risk mitigation measures that can support Fintechs in expanding SME finance

.png?width=937&height=546&name=Nasdaq_GFTN_937x546%20(2).png)

.png)

.png)

.png)