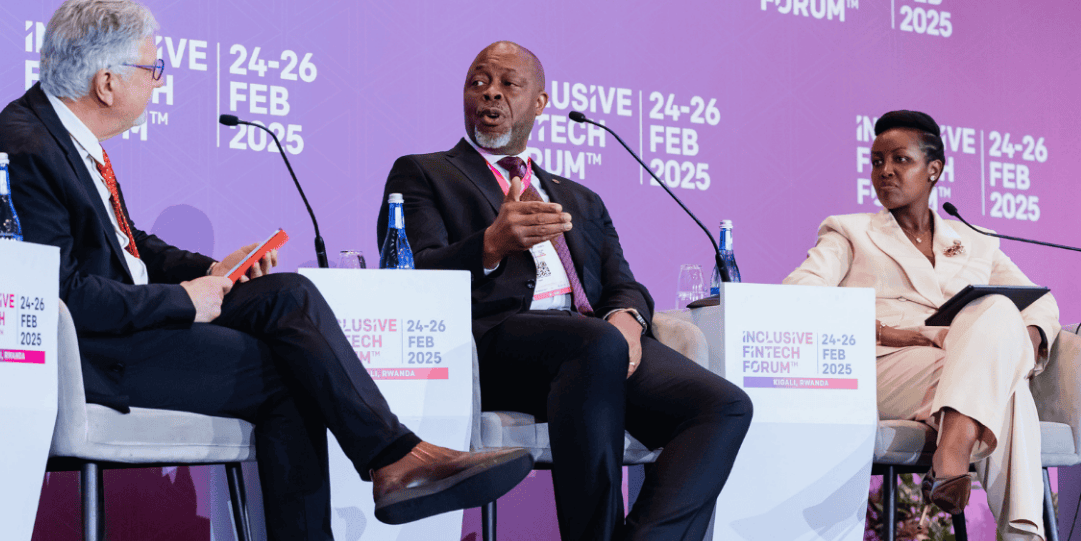

Following the successful discussion of the SME Banking Leaders’ League in the Global SME Finance Forum in Johannesburg, the Singapore edition at the Insights Forum will continue to shape actionable recommendations on the future of SME financial services to refine and globalise the League’s agenda.

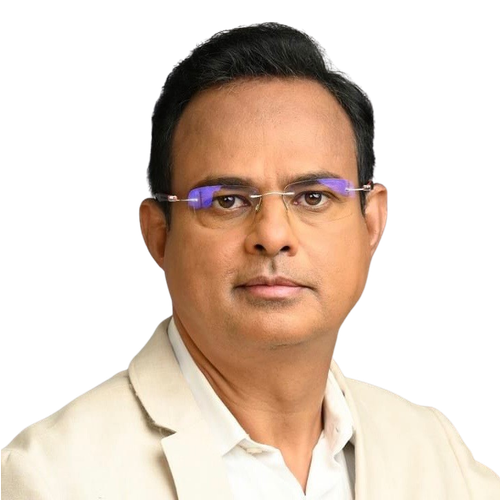

The SME Banking Leaders league is an ongoing group of leaders who form a recently created thinktank led by SME Finance Forum members. Objective would be for the recommendations to be taken forward by the core league and turn into an actionable plan with key milestones agreed.

1. Access to Markets – From Trade Corridors to Digital Marketplaces

- Beyond cross-border trade, how can SMEs plug into regional supply chains and digital platforms?

- Lessons from ASEAN’s fast-growing e-commerce and digital services sector.

- How financial institutions can act as enablers of _market access infrastructure_ (e.g. logistics financing, trade facilitation, cross-border payments).

2. Access to Skills – Digital Fluency and AI Readiness

- In Johannesburg, the focus was broad skills. In Singapore, sharpen to digital skills, AI adoption, and cybersecurity preparedness.

- What role should FIs, fintechs, and ecosystem partners play in building SME resilience against digital disruption?

- Can financial institutions become trusted _capacity-builders_ as well as financiers?

3. Access to Finance – New Instruments and new players

- Which innovative instruments should be prioritised globally and what additional considerations should be given to Asia’s specific context?

- _e.g. embedded trade finance, tokenised receivables, sustainability-linked loans, venture debt._

- Highlight SME participation in digital capital markets (tokenisation, green bonds, SME securitisation).

- Explore underserved growth segments: HealthTech, AgriTech, creative industries, and D2C brands.

.png?width=937&height=546&name=Nasdaq_GFTN_937x546%20(2).png)

.png)

.png)

.png)