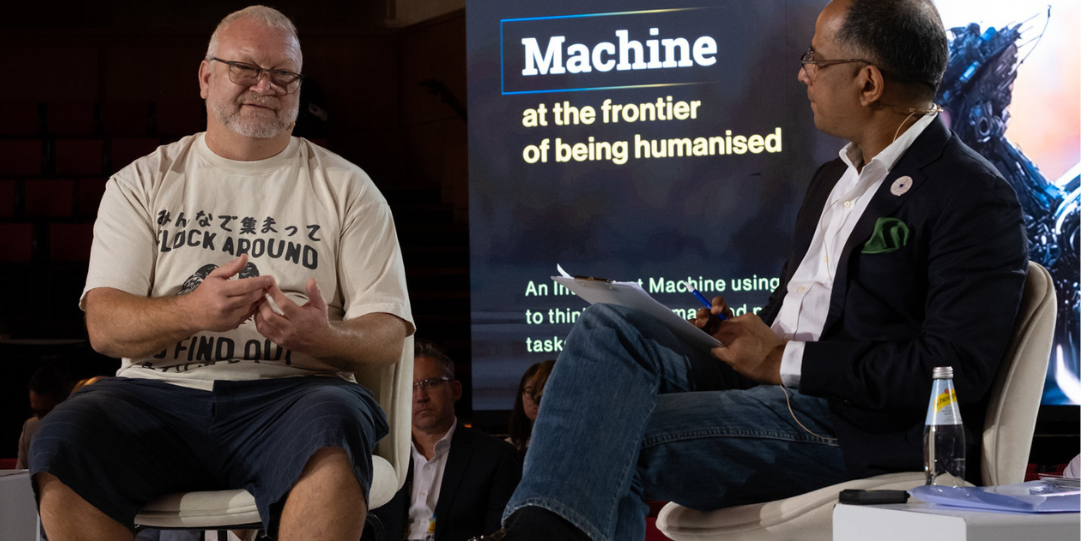

The Singapore FinTech Festival is a global nexus where policy, finance, and technology communities converge. Designed to foster impactful connections and collaborations. SFF is a platform to explore the intersections of cutting-edge financial solutions, evolving regulatory landscapes, and the latest technological innovations.

.png?width=937&height=546&name=Nasdaq_GFTN_937x546%20(2).png)

.png)

.png)

.png)